How to Compute SSS Contribution For Employed Individuals - The 2024 Guide

Let's face it, computing the Social Security System (SSS) in the Philippines can feel like cracking open a legal text document while blindfolded. But don’t be afraid, this concise guide aims to dissect the SSS contributions easily.

What is the Social Security System (SSS) in the Philippines?

In its simple definition, the Social Security System (SSS) is a government agency that operates as a social insurance program designed to safeguard its members and their beneficiaries. SSS is focused on the private sector, which means it administers social security protection for workers in private companies that are not under the government.

SSS contribution is paid by both employers and employees each month. These contributions are calculated as a percentage of your salary and act as building blocks for a robust social safety net that provides you with vital benefits in critical moments.

Why is Having an SSS Contribution Important?

SSS contributions are important for every employee as they provide financial security for its members and beneficiaries. Additionally, members are eligible to avail SSS provided benefits such as disability, maternity, sickness, retirement, funeral, and death benefits.

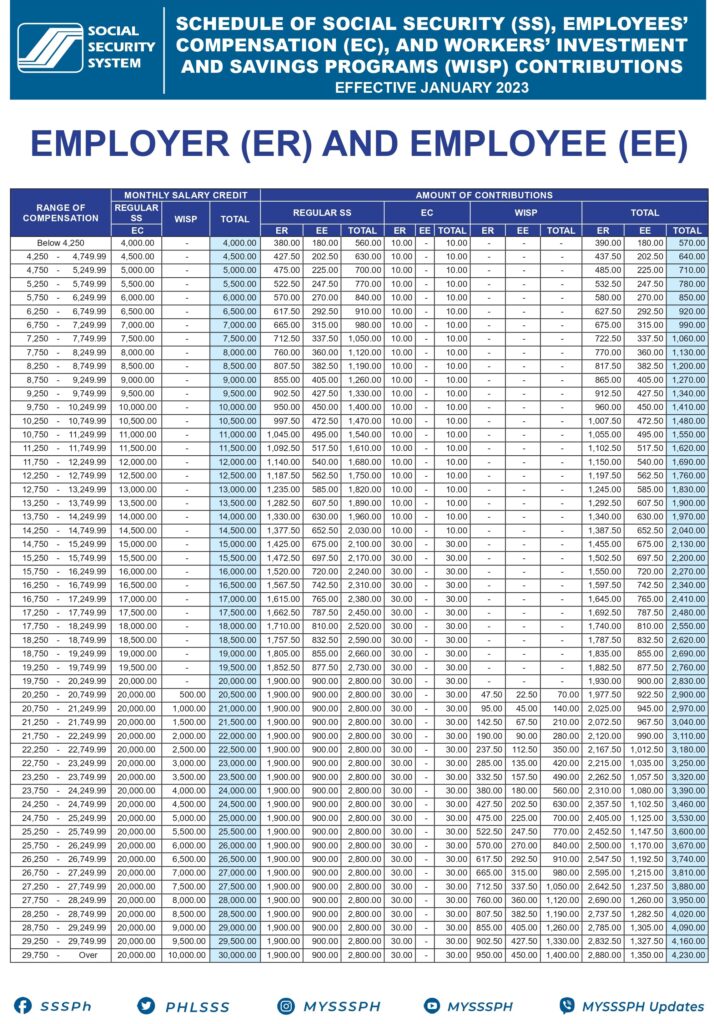

Understanding the Components of the SSS Contribution Table

The components of the SSS contribution table are explained below.

- Monthly Salary Credit (MSC) range. In simpler terms, it is the base figure used to determine your social security contributions and entitlements based on your monthly income.

- Employee (EE) contribution. It refers to the amount of money that employees contribute to the SSS fund. This contribution is deducted from the employee's salary or income.

- Employer (ER) contribution. It refers to the matching percentage that employers are required to add to their employees' SSS deductions.

- The Employees' Compensation (EC). Is a program that aims to assist workers who suffer work-connected sickness or injury resulting in disability or death.

- Worker's Investment and Savings Program (WISP). It is an SSS program that is intended for saving and investing. It is an affordable and tax-free savings scheme that allows SSS members to save.

- Total contribution. It is the combined total of all contributions made by the Employee (EE) and the Employer (ER)

How much is the current contribution rate for employed members?

SSS revamped its contribution structure in January 2023, with a new total rate of 14% based on the Monthly Salary Credit (MSC). Under this revised scheme, employers contribute 9.5%, with employees responsible for the remaining 4.5%.

Latest SSS Contribution Table 2024

The SSS contribution table for regular employees and employers is shown below.

Image source SSS Official Website

How to Compute SSS Contribution for Employed Individuals

Step 1. Match your income to the "Range of Compensation" table, then grab the corresponding MSC value from the "Total" column.

Step 2. For Employer's Contribution. Get your contribution share from the ER column based on your employee's MSC. For Employees Contribution. Get your monthly deduction in the EE column that matches your MSC.

Step 3. Get the employee compensation (EC) and add that to the employer contribution (ER).

Step 4. Look at the rightmost column to get the total contribution.

Example Scenario without WISP

Let's say that Anna’s income is 17,900.

Step 1. Looking at the table above, this falls in PHP 17,750 - PHP 18,249 range of compensation. Corresponding to that is PHP 18,000 Monthly Salary Credit (MSC).

Step 2. Based on the MSC, if we look at the table in the next column (ER & EE), Anna’s employer will contribute PHP 1,710, while her contribution is PHP 810.

Step 3. On the table, we can see that Anna’s employer will add PHP 30 as an EC.

Step 4.. On the rightmost, we can see that the total amount of contribution is 2,250.

SSS Contribution Formula

MSC x Contribution Rate = Total Monthly Contribution

If we take Anna’s income, for example, the computation would be:

18,000 * 4.5% (employee share) = PHP 810

18,000 * 9.5% (employer share) + PHP 30 (EC) = PHP 1,740 Total amount of PHP 2,250.

Who Uses the SSS Contribution Table?

The SSS Contribution Table isn't just for accountants! It empowers employees to verify deductions, employers to ensure compliance and self-employed individuals to tailor their security.

Employee. Check your table to confirm your employer's matching contributions, safeguarding your future retirement, disability, and sickness benefits.

Employers. Use the table as your legal and financial map. It guides your employee contribution percentages, fostering a secure workforce and good standing with the SSS.

Self-Employed. Choose your ideal "monthly salary credit" from the table to set your contribution and future benefits. You pay both employee and employer portions.

Please note that rates differ. Employees share the burden with employers through percentages, while self-employed individuals pay a fixed amount based on their chosen salary credit. Maximum salary bases also differ. Remember, the SSS Contribution Table is your key to a secure future. Navigate it wisely!

Automate your SSS Contribution using SATO Den Payroll

It’s 2024 now. Is your company still using old systems like spreadsheets to calculate your SSS contributions? Switch to SATO Den’s Payroll System now!

What are you waiting for? Book a demo now!

SATO Den streamline various time-consuming aspects of HR and payroll, going beyond just automating SSS contributions

- Attendance Management

- Leave Management

- Other contributions such as PhilHealth, PAG-IBIG, and Tax deductions!

Common Questions Regarding SSS Contributions Table

Our help does not end in guiding you on how to compute your SSS contributions, we’re also here to help you answer some common questions on SSS.

What happens if I overpay or underpay?

The SSS allows its members to apply for a refund if they made an overpay contribution.

Why did SSS Contributions Increase?

Contributions increase in the SSS help the agency to make better benefits to its members. Additionally, it creates more viable welfare funds for future generations. The latest changes to the SSS can be tracked on the Social Security Act of 2018. It is raised to 14 percent in 2023, one percent higher than in the previous year (2022). It is based on SSS Circulars No. 2022-033, 034, 035, 036, and 037, and was signed by SSS President CEO Michael G. Regino.

How can I check SSS contributions online?

To check SSS contributions, you can simply register on the SSS website. Please note that you should have at least one contribution to register. The SSS website will be your portal to check coverage, track payments, and claim status – all online.

Where can I find more information about the SSS?

You can visit the SSS website, or you may visit any SSS branch to ask their representative.

Wrapping up SSS Contribution Guide

Here is the recap of what is discussed in the article above.

Income below 250,000 is not subjected to income tax. Income above 8 million pesos has the largest income tax, with a whopping 2.2 million + 35% of the excess SATO Den Payroll Solutions can help your company with the hassle of manually computing tax deductions in payroll. Contact us now!